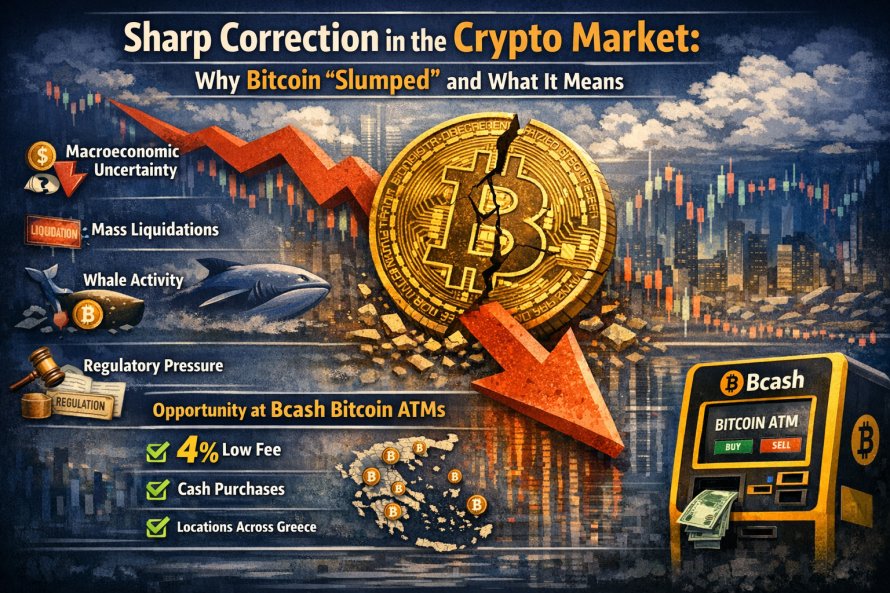

Sharp Correction in the Crypto Market: Why Bitcoin “Slumped” and What It Means

The cryptocurrency market has taken a strong hit in recent days, with Bitcoin posting significant losses and dragging the broader market down with it. The decline isn’t due to a single cause, but rather a combination of factors:

• Macroeconomic uncertainty: Concerns about interest rates and inflation in the United States and the European Union are making investors more cautious, pushing some toward “safer” assets and away from higher-risk investments.

• Mass liquidations: The drop below key technical levels triggered automatic sell orders on trading platforms, creating a chain reaction that accelerated the decline.

• “Whale” activity: Large holders moved significant amounts to exchanges, temporarily increasing supply and putting pressure on the price.

• Regulatory pressure: Rumors and/or announcements about stricter crypto oversight internationally fueled short-term panic among some investors.

Although the dip is causing concern, such corrections often act as a “reset” before the market’s next phase. For those with a long-term view, lower prices may represent an opportunity—always with proper risk management.

At Bcash Bitcoin ATMs, take advantage of a 4% fee for instant cash purchases, with no unnecessary charges or delays. Visit our network in Athens, Thessaloniki, and across Greece for safe transactions.

If you have any questions, you can contact our customer support service at +30 6987812000 & +30 6998499499 (Viber, Whatsapp, Telegram supported).