OTC: Trade Bitcoin the smart way!

Benefit from Bcash’s advantageous Over-The-Counter crypto service and avoid the risks associated with centralized exchanges

If you are a would-be cryptocurrency trader, purchasing digital assets through a traditional exchange exposes you to several risks. Moreover, when it comes to buying (or selling) large amounts of cryptos, the risks multiply exponentially.

Not only can slippage greatly increase the cost of a trade, but you willl also need to deal with the risks of hacking and theft that come with trading on an ordinary exchange, as well as higher taxation in many cases.

This is where Bcash comes in. OTC trading can eliminate all these problems, making sure your transactions are instant, direct, reliable, trusted, safe, and above all else, advantageous for both parties. The OTC service that Bcash has to offer is ideal especially for bulk transactions - big volumes of Bitcoin or other cryptocurrencies.

But what exactly is OTC trading?

Over-the-counter (OTC) or off-exchange trading is done directly between two parties, without the supervision of an exchange.

Breaking down the term: OTC is a security, or in our case, a cryptocurrency, traded in some context other than on a formal exchange such as the New York Stock Exchange (NYSE). The phrase "over-the-counter" can be used to refer to financial products that trade via a decentralized dealer network, such as Bcash.

Bcash’s specialized dealers create favorable market conditions for the would be buyer, simplifying the trades. The most successful investors favor OTC traders over centralized exchanges for their transactions.

Cryptos traded on a traditional exchange must be well standardized. This means that exchanged deliverables match a narrow range of quantity, quality, and identity which is defined by the exchange and identical to all transactions of that product. This is necessary for there to be transparency in trading.

The OTC market does not have this limitation. They may agree on an unusual quantity, for example. In OTC, market contracts are bilateral (i.e. the contract is only between two parties). Contrary to a centralized exchange, in an OTC trade, the price is not necessarily published for the public.

Why would someone use OTC instead of a regular exchange?

Why would you bother with OTC trading when there’s a huge variety of traditional cryptocurrency exchanges offering simple fiat-to-crypto transactions? There are several reasons why:

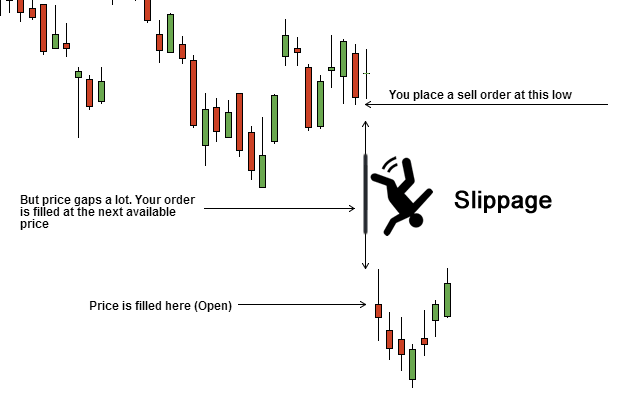

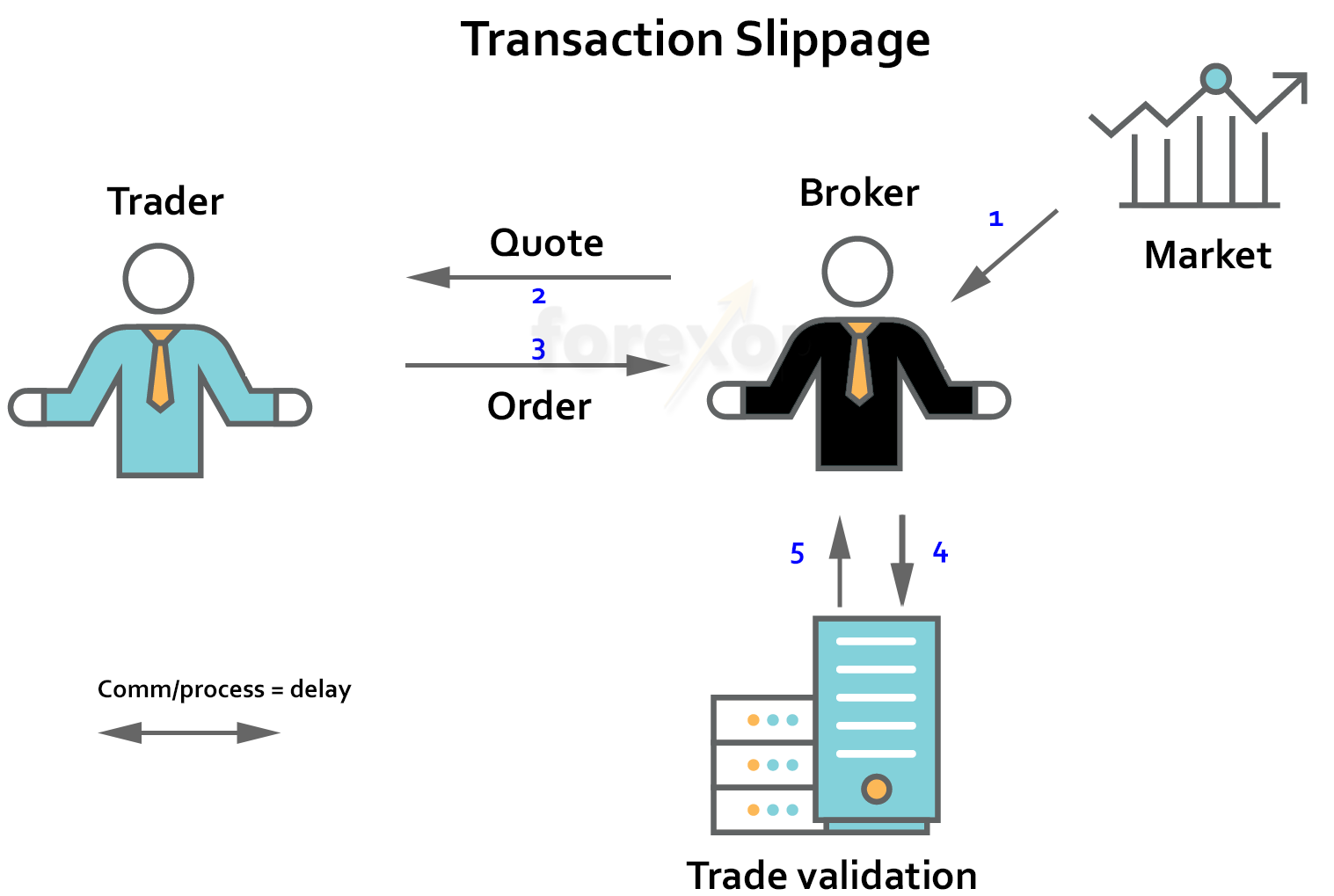

Better prices: The traditional (on-exchange) cryptocurrency market is still in its infancy, and there may not always be sufficient liquidity available on exchanges to process large trades. As a result, placing a substantial trade through a traditional exchange could move the price of a cryptocurrency in an unfavorable direction before your trade could be completed – this is known as slippage.

Instead of being filled for a single price, large orders can end up being spread over several smaller orders, with the price of each order often increasing. OTC trading allows traders to access one price for a single buy order.

IMPORTANT! - Slippage is when a cryptocurrency price changes while an order is being filled, resulting in a different price than expected for a trade. It’s a common drawback associated with placing larger trades on traditional exchanges since insufficient liquidity on an exchange can lead to a single order being split into several smaller orders. Before all of those smaller orders can be filled, the price could shift in an unfavorable direction, resulting in a more expensive purchase than originally desired.

For example, if a «whale» (a wealthy crypto wallet) attempts to buy e.g. 100 Bitcoins through a regular exchange and the current market price is 3.800 dollars, the buy price of at least half of those Bitcoins will be far greater than the starting price (e.g. 4.000$), due to slippage, increasing the final cost of the transaction significantly, at the expense of the buyer of course.

In the same case scenario of an OTC trade, all 100 Bitcoins would be bought at the fixed market price of 3.800 dollars per Bitcoin, that both parties agreed. The benefit is obvious.

Moreover, OTC can save you a lot of cash from taxation, which in many cases, is illogically high in crypto trading. For example, when trading in USA exchanges, any more than 3 traders per year result in big taxes.

Avoid low trading limits: Most traditional exchanges place a limit on the maximum amount a user can trade per day as well as on the amount that can be withdrawn from an account in a 24-hour period. These limits can also vary based on factors such as the transaction methods used, the level of account verification completed and how long a user has been trading with the platform. In many cases, they may be insufficient to meet the needs of large-scale traders.

Quicker trading times: Depending on the liquidity available, large trades can take days to be completed on a traditional exchange. Using OTC trading can guarantee faster processing times. Often offers a faster settlement of large trades and quicker access to your funds than exchange-based transactions.

Safety first! Use a trusted, reliable broker, such as Bcash. There have been numerous examples of traditional cryptocurrency exchanges being targeted by, and all too frequently falling victim to, hacking attacks. Placing OTC trades through a trusted broker allows you to avoid this risk. There are numerous other risks one is exposed to, when trading in regular exchanges. For example, a major Canadian crypto exchange went bankrupt recently, when it’s CEO (who kept the only key with access to $140 million worth of customer’s wallets) died, with no way of getting the keys back!

The crypto market is still young, and there are other unpredictable risks that linger. In such cases, there is no guarantee of reimbursement, and even if there is, money (or crypto) is usually refunded after a long time, and, if anything, time is money in this extremely volatile market…

All in all, over-the-counter trades obviously offer great comparative advantages as opposed to centralized exchanges, especially in this early stage of a still young and immature crypto market, which still suffers from low liquidity, high volatility, shady and illogical regulations, great vulnerability to hackers, as well as other unpredictable factors.

Bcash’s OTC service is the ideal choice not only for the large-scale trader, but also for the smaller yet wise investor who wishes to avoid the risks associated with centralized exchanges.